Applying for a Home Equity Loan or HELOC in 2023

Table of Content

If you took out the maximum amount on your first home equity loan, you may not have enough equity left to support another loan. In addition, lenders typically require an appraisal to determine the value of the home, which in turn determines how much equity the owner has. Stephanie is a DC-based freelance writer, specializing in a range of personal and household finance topics. She has an undergraduate degree from Baylor University and is currently a candidate for CFP certification. You can find her work on sites such as MSN, Yahoo! Finance, Fox Business, Investopedia, Credit Karma, and much more. Beyond that, personal factors such as your credit score and DTI can reduce your maximum LTV.

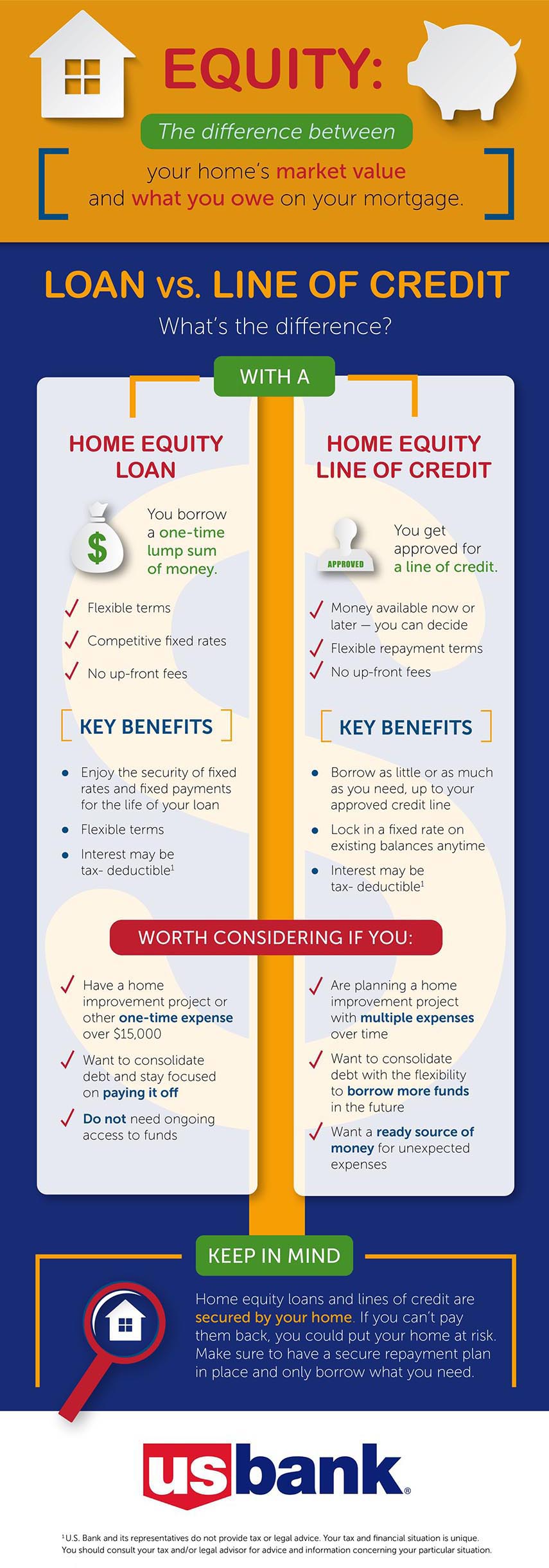

The percentage of your home's available value is called the "loan-to-value ratio," and what's acceptable can vary from lender to lender. Some allow LTV ratios above 80%, but you will typically pay a higher interest rate. You'll typically make fixed monthly payments on a lump-sum home equity loan until the loan is paid off.

What Is the Best Way to Get Equity Out of Your Home?

Typically, the higher your credit score, the better rates and terms you receive. If you are considering a HELOC, you may first want to evaluate the current market rates and determine how you want to use your funds if you qualify for a HELOC. Home equity lenders will make their decisions based on your current credit standing. So if you've continued to maintain a solid credit record since you took out your original mortgage, you may be fine. However, if you've had a spottier record since then, you might face difficulties. However, if you are approved, you will likely not have as attractive an interest rate as you would with a better score.

We have many Home Equity calculators for you on our calculators page, to get started use this home equity calculator to easily calculate the equity in your home. You can borrow against your equity to pay for home renovations, college education or any other expenses that come up. It involves refinancing your existing mortgage into a smaller one and taking the difference between the two as cash. If you itemize deductions, you may be able to deduct interest costs if you use the proceeds of a HELOC for home improvements.

Your debt level shouldn't exceed 43%

Over the last 12 years, he has also studied and covered taxes, politics, and the economic impacts policy decisions have on small business. Be prepared to provide income verification information when you apply for your loan; examples of documents you may be asked for are W-2s and paystubs. To determine your LTV, divide your current loan balance by the appraised value of your home. For instance, if your loan balance is $150,000 and an appraiser values your home at $450,000, you would divide the balance by the appraisal and get 0.33, or 33 percent. Since your LTV ratio is 33 percent, you have 67 percent equity in your home. At Bankrate we strive to help you make smarter financial decisions.

Before making the decision between a home equity loan and a HELOC, it’s important to understand how much money you’ll need and for how long. HELOCs are an alternative to traditional loans and are designed to serve a qualified homeowner’s needs. You can use a HELOC to pay for large one-time or ongoing expenses, such as home renovations or college expenses. Debt consolidation is the act of combining several loans or liabilities into one by taking out a new loan to pay off the debts. Creditworthiness is how a lender determines that you will default on your debt obligations or how worthy you are to receive new credit.

How to qualify

And it can help if your other financial qualifications are strong. Take advantage of your home's Equity and keep your first mortgage rate! Home equity loans can provide you extra cash to pay for things like a wedding, college tuition, vacations and emergency expenses. We offer great Fixed Rate Home Equity Loans with terms to fit your budget and easy monthly payments. Leave your information below and a loan officer will contact you.

You also need to have sufficient equity built up in your home, especially if you’re attempting to secure a home equity loan with bad credit. Lenders use what’s called a loan-to-value ratio that divides your current mortgage balance against your home’s current appraised value. For example, if your home is worth $300,000 and you still owe $240,000 on your mortgage, your LTV is 80% ($240,000/$300,000). Most lenders require a score of at least 680 in order to get approved for a home equity loan. However, you may still be able to qualify for a home equity loan with bad credit. Since home equity loans are secured by your property, meaning your home serves as collateral if you default on the loan, there’s less risk to the lender.

Closing costs vary by lender, so compare costs before choosing a company. You can use an online real estate listing site like Zillow to get an idea of how much your home is worth. You can further estimate your home value by seeing how much similar homes in your neighborhood sold for. Note that this number might not be accurate and should be used for a rough estimate only. That are growing in valuation because they can borrow more money as property values rise. You can get a ballpark estimate by asking a local real estate agent or checking what homes comparable to yours have sold for recently.

But if you have a balance on your mortgage of $200,000, you need to subtract it from the $255,000 maximum the bank will let you borrow. Lender requirements may vary, but there are standard guidelines needed to qualify for a home equity loan or a HELOC. A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. First, of course, you will have to have equity to borrow against.

Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. He covers banking, loans, investing, mortgages, and more for The Balance. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades.

A full refinance could include more upfront costs, which is why you might prefer a home equity loan. Additionally, interest rates could be higher than what you have on your current mortgage. Instead, you could choose a home equity loan and refinance later when rates come down to combine the two payments into one mortgage. If you have a significant sum invested in CDs and hit an unexpected financial emergency, you may wish you could get at those funds without having to pay early withdrawal fees.

The five Cs of credit are important because lenders use them to set loan rates and terms. Since your home equity loan is secured by using your house as collateral, failure to pay your loan could result in your lender foreclosing on your house. Once you apply for your home equity loan, your lender may order an appraisal to determine the current market value of your property.

Beware of red flags, like lenders who change the terms of the loan at the last minute or approve payments that you can’t afford. A home equity line of credit typically allows you to draw against an approved limit and comes with variable interest rates. A home equity loan is a type of second mortgage that allows you to borrow against your home’s value, using your home as collateral. At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners.

Best For Real-time Rate Estimates

This includes performing a hard pull of your credit report and requiring proof of your income. This has many homeowners — maybe you — asking whether the time is right to access the cash you have tied up in your home. If you are unsure how much equity you want to borrow, consider applying for a home equity line of credit instead.

Comments

Post a Comment